Alabama Form 2848a Instructions

What makes the alabama form 2848a instructions legally binding?

Because the society ditches in-office working conditions, the completion of documents increasingly happens electronically. The alabama form 2848a instructions isn’t an any different. Handling it utilizing digital means differs from doing so in the physical world.

An eDocument can be considered legally binding on condition that particular requirements are met. They are especially vital when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not ensure that the institution requesting the form or a court would consider it executed. You need a reliable solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your alabama form 2848a instructions when completing it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make form execution legal and secure. Furthermore, it provides a lot of possibilities for smooth completion security wise. Let's quickly go through them so that you can be assured that your alabama form 2848a instructions remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Dual-factor authentication: adds an extra layer of security and validates other parties identities through additional means, like a Text message or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information securely to the servers.

Completing the alabama form 2848a instructions with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete alabama form 2848a instructions

Complete alabama form 2848a instructions effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without issues. Manage alabama form 2848a instructions on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly modify and eSign alabama form 2848a instructions

- Obtain alabama form 2848a instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign alabama form 2848a instructions while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Alabama Form 2848a Instructions

Create this form in 5 minutes!

How to create an eSignature for the alabama form 2848a instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new employee tax form for Alabama?

The W-4 form covers all federal taxes, and the A-4 form focuses on Alabama state taxes. The purpose of this form is to withhold certain state taxes and determine if an employee is exempt from certain taxes.

-

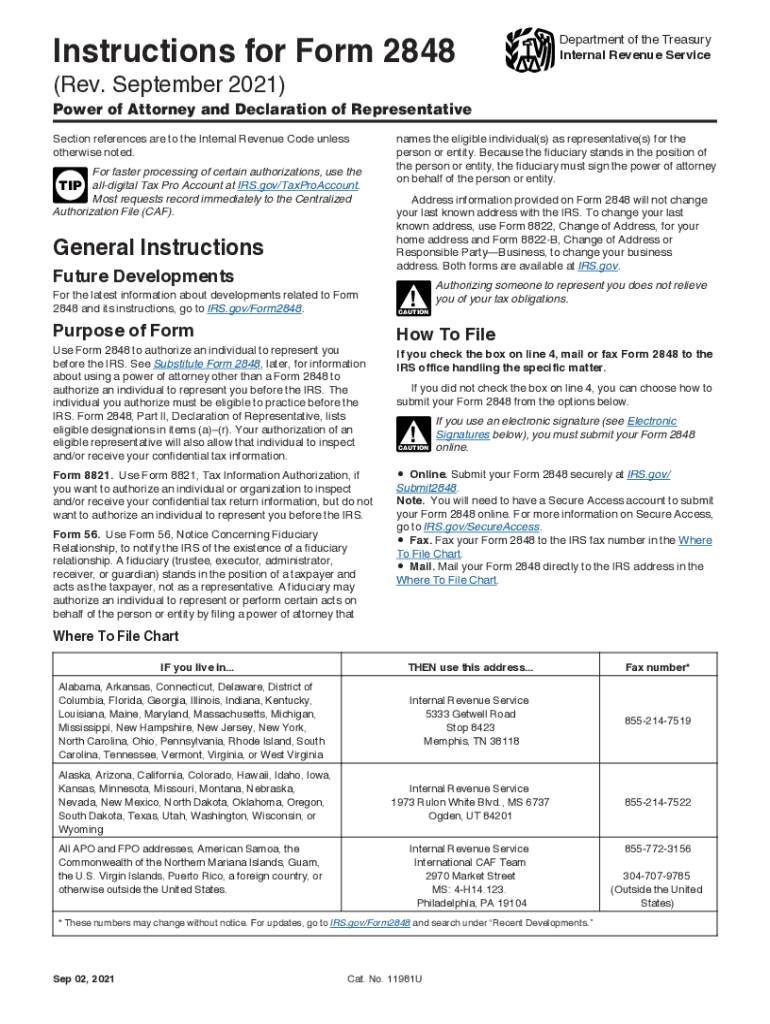

How do I fill out a 2848 tax form?

Filling out Form 2848 involves providing taxpayer information in Part I, declaring representative's eligibility in Part II, and stating specific authorized tax matters in Part III. Avoiding common errors such as missing signatures or incorrect form numbers ensures successful authorization.

-

What is the Alabama A4 form?

The A-4 Form tells a payroll provider how much money to withhold from an employee's paychecks to ensure they are correctly paying taxes to the state of Alabama through the year. Alabama employees must submit an A-4 along with a W-4.

-

How do I file my business privilege tax return in Alabama?

Alabama Business Privilege Tax Returns must be filed by mail. To download and print your tax return, you'll need to visit the Alabama Department of Revenue website. On the state website, click “Forms” on the top menu. Once you're at the “Forms” page, type “Alabama Business Privilege Tax Return” in the Title Search box.

-

Does Alabama accept federal form 2848?

For an authorized representative to act on your behalf, you must sign a Power of Attorney and Declaration of Representative (Alabama Form 2848A) or similar form (such as a federal power of attorney Form 2848) which designates you as the taxpayer, identifies the type of tax or assessment, identifies your authorized ...

-

What is form 40A in Alabama?

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only.

-

What is the employee tax in Alabama?

Persons claiming single or zero exemption: 2 percent on first $500 of taxable wages, 4 percent on next $2,500, and 5 percent on all over $3,000. Persons claiming married exemption: 2 percent on first $1,000 of taxable wages, 4 percent on next $5,000, and 5 percent on all over $6,000.

-

Does Alabama have self-employment tax?

Federal Self Employment Tax Self-employed individuals in Alabama must pay federal self-employment tax. This tax is calculated at a rate of 15.3%, which includes contributions to Social Security and Medicare.

Get more for Alabama Form 2848a Instructions

- Bbs form 37a 524a cfc hours 2010

- Personal history statement boise police department police cityofboise form

- Qr7 form

- Child care facility roster 1999 form

- Kaiser permanente forms medical release forms 2003

- Facility network request form fnrf provider express

- Vs117be form

- California state fund mileage form 2013

Find out other Alabama Form 2848a Instructions

- Electronic signature Utah Apartment lease form Free

- Can I Electronic signature Utah Apartment lease form

- Electronic signature Utah Apartment lease form Secure

- Electronic signature Alaska Standard lease form Online

- How To Electronic signature Alaska Standard lease form

- How Do I Electronic signature Alaska Standard lease form

- Electronic signature Utah Apartment lease form Fast

- Help Me With Electronic signature Alaska Standard lease form

- How Can I Electronic signature Alaska Standard lease form

- Electronic signature Alaska Standard lease form Computer

- Electronic signature Utah Apartment lease form Simple

- Can I Electronic signature Alaska Standard lease form

- Electronic signature Utah Apartment lease form Easy

- Electronic signature Georgia Residential lease Online

- Electronic signature Alaska Standard lease form Mobile

- Electronic signature Georgia Residential lease Computer

- Electronic signature Georgia Residential lease Mobile

- Electronic signature Utah Apartment lease form Safe

- Electronic signature Georgia Residential lease Now

- Electronic signature Alaska Standard lease form Now